- Market Overview

-

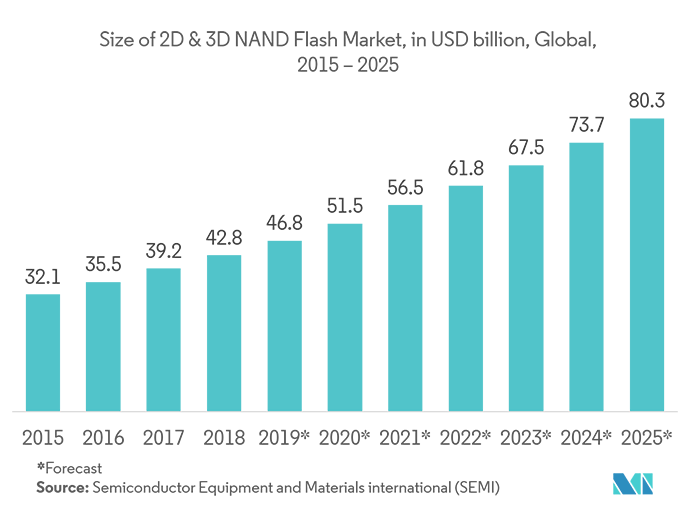

The solid state drive (SSD) market was valued at USD 34.86 billion in 2019, and it is expected to witness a CAGR of 14.94% during the forecast period (2020 - 2025), to reach USD 80.34 billion by 2025. Technological advancements by large companies in existing SSD, with facilities like 1 GB/s sequential read speed, high-speed continuous shooting at 960 frames per second, are boosting the market growth.

- With the splurge in big data brought about by IoT devices and enterprise applications, the importance for faster storage has become essential, thus, giving rise to the development of mega-sized SSDs and increased research on how to make larger SSDs at a lower cost.

- Moreover, high capacity SSDs are typically used for cloud applications, for instance, to support content sharing traffic, such as media streaming and video, as well as active archiving applications, where highly sensitive information is not being overwritten. This has enhanced the enterprise SSDs to strike a balance between capacity and performance.

- With the introduction of smart devices and wireless technologies, in-vehicle-infotainment (IVI) system is able to play music and videos, and find the fastest route by analyzing real-time traffic information, both of which require reliability on the data executing speed of the storage devices in the system. In this aspect, SSDs are the best solutions for executing big data. In strict environments, such as low air pressure or high humidity atmosphere, the mechanic-free structure of SSD has made it more trustworthy than HDD.

- Rising Demand from Enterprise Segment to Augment the Market Growth

-

- The earliest SSDs for enterprises used SLC (single-level cell) NAND flash, which stores one bit per cell and offers the highest level of endurance and performance, with a typical lifecycle of 100,000 writes per cell.

- The improvements to NAND flash technology have enabled the enterprise SSD manufacturers to use lower-endurance NAND flash options, such as a multi-level cell (MLC), triple-level cell (TLC), 2D NAND, and 3D NAND. Advantages of the lower-endurance forms of NAND flash include lower cost and higher capacity, which have spurred the market growth.

- Moreover, flash storage is at the core of the increase in enterprise data. Flash is increasingly becoming integral in helping both storage vendors and data center operators weather an IT landscape that is being reshaped by next-generation workload.

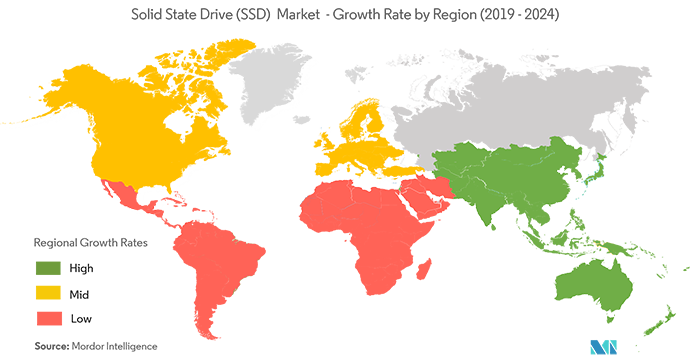

- North America Region Expected to Hold Significant Share

-

- According to Seagate Technology PLC, an American data storage company, in the near future, in the United States, cloud storage is expected to continue to grow, both by the desire to reduce latency by locating data closer to the consumer, as well as due to the regulatory and corporate mandates demanding data to be housed locally within different part of the regions. Thus the region is likely to witness significant demand for SSD storage devices.

- Moreover, the growth of 5G technology in the United States and Canada is expected to contribute to market demand. The FCC (Federal Communications Commission’s) Spectrum Frontiers Order has set the groundwork for the use of 5G technology in the United States by the end of 2020. Therefore, most of the small and large enterprise and cloud storage companies in the United States are accelerating the transition from hard disk drives (HDDs) to solid-state drives (SSDs) to be ready for 5G.

- Competitive Landscape

-

The solid-state drive (SSD) market is dominated by major vendors, such as Intel, Micron Technology, Samsung Electronics, Toshiba, and Western Digital Corporation. As the entry barriers in the market are high, the entry of new players is difficult. The existing vendors in the market are investing heavily in the R&D of new and innovative products.

- April 2019: Intel introduced Intel Optane memory H10 with solid-state storage that combines the responsiveness of Intel Optane technology with the storage capacity of Intel Quad Level Cell (QLC) 3D NAND technology in an M.2 form factor.

- March 2019: Western Digital Corp. is accelerating the NVMe transition of value-PC storage by adding an NVMe model to its WD Blue solid state drive (SSD) portfolio, the WD Blue SN500 NVMe SSD. The new SSD delivers three-times the performance of its SATA counterpart while maintaining the reliability of the WD Blue product line.

- January 2019: Intel launched its Optane SSD DC P4801X Series that offers advanced technologies and features, such as enhanced power loss data protection, high-endurance technology, and end-to-end data protection.